The Federal Budget in May will shed light on how quickly the government plans to tighten its belt. Treasurer Josh Frydenberg has today reiterated that his first priority is the economic recovery, and the government appears poised to spend more on job creation to drive unemployment below its pre-crisis level of 5.1 per cent before turning its mind to consolidating the budget. Prioritising the economic recovery over deficit reduction is a sensible strategy, as we argued before last year’s Budget.

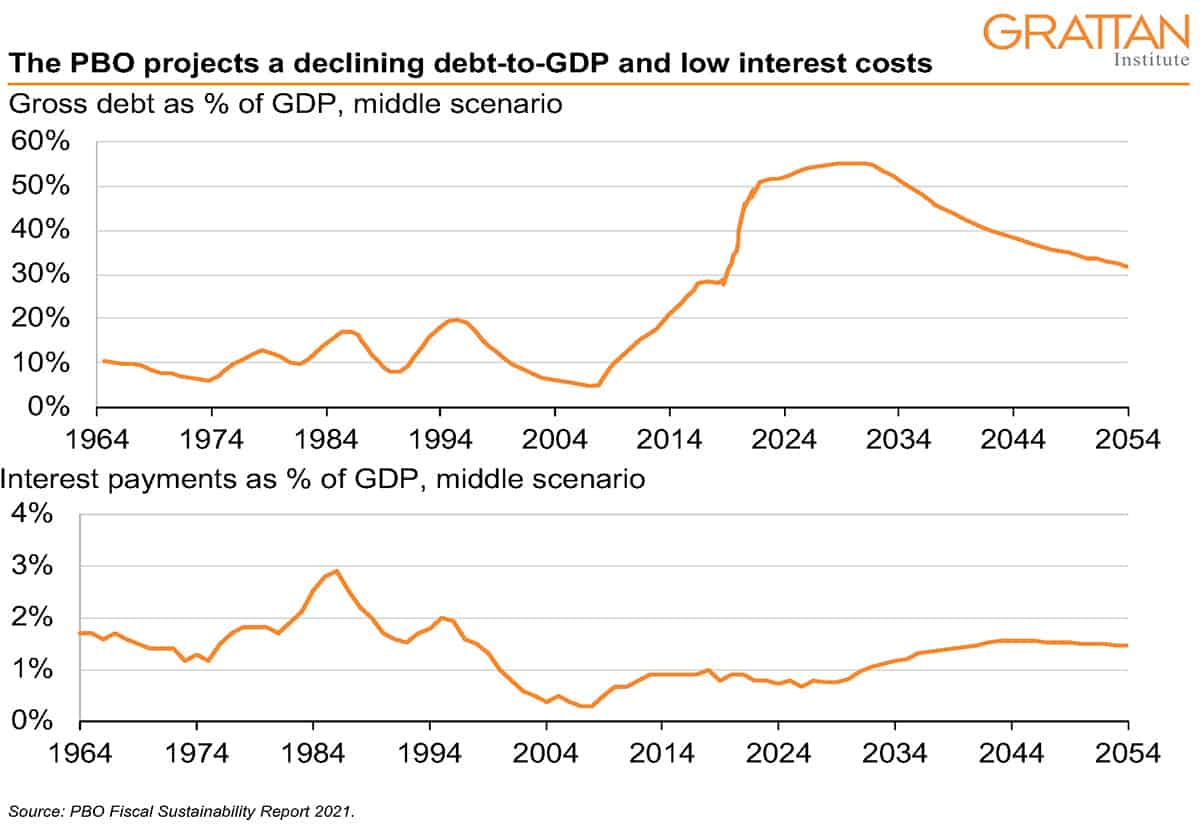

And a report released this week by the independent Parliamentary Budget Office (PBO) affirms that there is no need to be concerned about whether our debt levels are sustainable over the medium-term. The PBO does not project any realistic scenario where the overall level of debt fails to stabilise as a share of the economy, and the interest cost of debt – an important measure of debt sustainability – remains at a manageable level in every scenario.

The PBO’s projected scenarios test a range of assumptions for the three key determinants of debt sustainability: the budget balance, the interest rate on government borrowing, and nominal economic growth. In its medium scenario (see figure), the interest rate on 10-year bonds is assumed to reach its long-run rate of just over 5 per cent in about two decades (the same assumption underpinned the 2020-21 Budget). The budget (including interest costs) is assumed to be in a structural deficit. And nominal GDP growth is assumed at about 5 per cent, based on assumptions about population growth from the Australian Bureau of Statistics and participation and productivity assumptions rom the last Intergenerational Report, published in 2015. Subsequent scenarios alter one, two, or all three of these assumptions above and below the medium level.

One of the main reasons for the stable outlook across multiple scenarios is the interaction between the interest rate on borrowing and GDP growth. The current interest rate is at a historic low, well below the nominal growth rate. And even the long-run interest rate – which is two decades away in the medium scenario – is similar to the nominal growth rate. When growth outstrips interest rates, the amount of debt relative to the economy can fall even if the government continues to run deficits. In fact, if inflation picks up while interest rates are still low, there may even be a period where the real interest costs are negative – that is, the government is effectively being paid to borrow.

The upshot is that, under the range of economic conditions the PBO considers in its projections, debt as a share of GDP can remain stable and in some scenarios may even fall without a surplus.

As the PBO acknowledges, the level at which debt would ‘stabilise’ in its projections and in the Government’s aspirations is still a much higher level than it was before the pandemic – debt will remain more than half the size of GDP for at least a decade, and it would take decades to return to the pre-pandemic level of 28 per cent even under the most optimistic assumptions. But Australia’s debt levels are low by international standards, and they will not undermine the sustainability of the government’s finances – or the confidence of consumers and businesses – for as long as interest costs remain manageable and the level of debt remains stable.

All of this means that the Government does not need to cut overall spending to ‘get its house in order’, especially if that spending would have supported economic growth. Well-targeted stimulus in the immediate-term and productivity-enhancing reforms over the short- and medium-term can boost growth and improve the government’s debt position at the same time.

Medium-term projections are necessarily uncertain. As the PBO points out, long-term structural shifts such as global warming could permanently alter expectations of growth and budgets and could also alter expectations for interest rates and the level of debt if they reduce Australia’s attractiveness as an investment location relative to other countries. These types of structural risks represent one reason why sound fiscal management remains a worthy objective. Another is the need to leave the ‘fire power’ to respond to future cyclical shocks.

The strategy the Treasurer has outlined today appears sensible – the benefits of getting unemployment down and wages growing are big, and, as the PBO report confirms, the downside risks to long-term fiscal sustainability are small.