A defining feature of the COVID-19 crisis is the uncertainty it’s created. Just how deadly is COVID-19? Will relaxing lockdowns lead to second and third waves of infections? And how far off is a vaccine, if we ever get one? These questions have enormous implications for our health and prosperity. Yet there are still no good answers.

The uncertainty could be very costly for the Australian economy. Firms are unlikely to invest, and households unlikely to spend, unless they’re confident COVID-19 won’t re-emerge.

Economic uncertainty spiked to recession levels in March but fell a bit in April

The Economic Policy Uncertainty Index, created by US-based economists Scott Baker, Nick Bloom, and Steven Davis, measures the frequency of articles featuring words such as ‘economics’, ‘policy’, and ‘uncertainty’ across eight major Australian newspapers. The creators have shown that past bouts of uncertainty have foreshadowed declines in investment, employment and GDP.

The Economic Policy Uncertainty Index for Australia rose sharply in March to levels higher than during the Global Financial Crisis. The index fell a little in April but remains well above pre-COVID-19 levels.

And while economic uncertainty in Australia might be declining in response to our ccess in controlling the virus here, uncertainty globally remains at record highs especially in the world’s two largest economies: the United States and China.

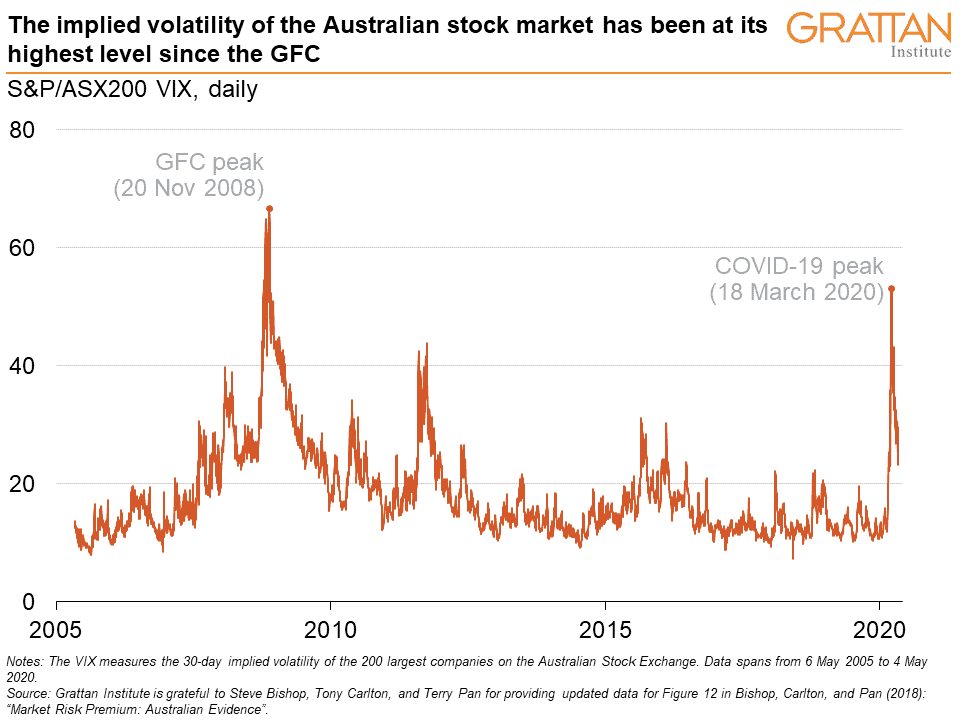

Financial measures of uncertainty tell a similar story

The S&P/ASX 200 VIX, commonly referred to as the ‘investor fear gauge’, measures sentiment about the future volatility of the ASX 200 index of Australian equities based on options prices. It hit its highest level in 10 years on 18 March, the day the Federal Government recommended all Australians abroad should return home as soon as possible. The VIX has declined since then but remains above its pre-crisis trend.

Uncertainty matters for Australia’s economic recovery

Research from the Reserve Bank of Australia in 2016 found that high uncertainty causes households to save rather than spend, and firms to act more cautiously, reducing investment and employment growth. More recent research by the creators of the Economic Policy Uncertainty Index suggests that United States GDP could decline by 11 per cent by the end of 2020, and about half of the fall could be due to the record high levels of uncertainty.

The shutdowns to control the spread of COVID-19 in Australia have hit consumer and business confidence hard. An ABS survey of businesses released this week found more than two-thirds expected a reduction in turnover or cash flow as a result of COVID-19 in the next two months, compared to 53 per cent that expect their operations to be restricted by government public health responses.

The investment, hiring, and spending required for a strong recovery are unlikely to occur until the uncertainty is resolved. While the Federal Government is spending almost $200 billion in the next six months to insulate Australians from the economic costs of COVID-19, there will be no sustained economic recovery in Australia until we’re certain we’ve got the virus under control. And unfortunately, even if COVID-19 lockdowns soon end, the uncertainty over whether they’ll need to return won’t go away.