Published at The Conversation, Wednesday 14 May

Treasurer Joe Hockey’s first budget creates a clear path almost to a surplus. Our children will pay much less for current spending. Real political courage was required to get this far.

But the budget also creates problems for the future that will drag on economic growth and hurt the less fortunate. Over the next few years the Abbott government will have to make even tougher choices that both keep the budget in balance and do more to promote economic growth and fairness.

Even in four years’ time the budget does not quite balance – and it should already be balanced given that the economy is not doing too badly. Some of the choices, particularly the timing of the deficit levy and increases in infrastructure spending, seem almost designed to avoid claiming a surplus. The budget ducks the possibility of under-delivering on a surplus, but only by under-promising.

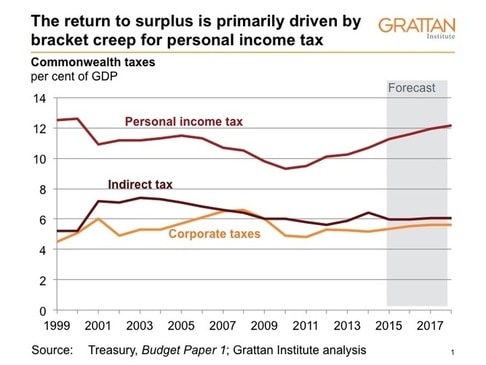

Bracket creep does most of the work of budget repair. Fixed income-tax thresholds and wage inflation will take personal income tax from 11% to 12% of GDP. This is worth about $18 billion in today’s terms. Income tax has not been at these levels since the GST came in.

Real spending reductions and a few tax increases also help to reduce the budget deficit. New decisions will improve the budget bottom line by about $10.5 billion in 2016-17. It will be the sharpest sustained slowdown in spending since the “recession we had to have” of 1990. Commonwealth spending on health will shrink as a proportion of GDP for the first time in a long while.

The Treasurer promised the burden would be shared across the community. The budget is clearly designed around this principle, which is likely to make the package easier to sell. Patients, students, families, pensioners, the unemployed and high earners will each contribute $1 billion to $2 billion fairly directly to the bottom line. However, the largest line item in the budget, the Age Pension, will continue to consume more of the Commonwealth budget and national resources, despite some minor tinkering.

False economies in the budget

Unfortunately, many of the things helping the budget to surplus will drag on economic growth and well-being.

Co-payments for medical services and pharmaceuticals are likely to lead to more sickness that far outweighs any budget savings. Similar co-payments elsewhere have led to people seeing the doctor less. Some didn’t really need to see a GP, but far more missed out on valuable treatment.

The budget also unilaterally tears up the Commonwealth’s promises to help states with the growth in hospital spending. In effect, the Commonwealth has told the states they will have to absorb most of the coming cost increases in health as new and more expensive treatments keep proliferating and the population ages. This doesn’t solve the budget problem, just transfers it to another level of government.

The budget’s reliance on bracket creep is also likely to discourage workforce participation, particularly among women thinking about returning to work who often take home very little of what they earn. By 2017-18 – after the deficit levy is due to expire – middle-income earners will pay an extra 1.8% of their incomes – $744 a year – in tax. Some will lose family payments on top of that.

Similarly, although bush economists might be attracted by “work for the dole” schemes, and these are likely to reduce claims for unemployment benefits, the evidence shows that these schemes hinder people finding proper long-term jobs. Combined with uncapped university fees and charging real interest for student loans, which may start to deter people from going to university, this budget could reduce how much Australia’s workforce produces in the long term.

The government’s controversial Paid Parental Leave Scheme remains in the budget, although you would need a microscope to find it buried in the budget papers as an “other” variation from the November economic statement. The best one can hope is that it never eventuates – and if the company tax changes that were to part-fund the scheme don’t happen, then the budget will get a collective boost of $4 billion a year. That money could be put to better use making childcare more affordable.

The budget’s main claim to economic responsibility is its new infrastructure spending, about $3 billion in 2016-17. That is smaller than you might think if you listened to the announced package, which conflates spending over a number of years, as well as already announced spending. And the claimed economic benefits may be much smaller than assumed.

Not one of the material projects getting new money from the government israted by Infrastructure Australia as “ready to proceed” – indeed not one even falls into their “on the threshold” category. Many are not even rated as projects with “real potential”.

The rigorous independent cost-benefit analysis of projects simply hasn’t been done. Given past experience, we should be sceptical about accepting politicians’ claims that their instincts are a good substitute.

So this budget may reduce the deficit, but it reinforces the need for much better quality policy in future to encourage economic growth and well-being. Better unemployment, health and transport infrastructure policies will be needed. The big reforms, as identified in Grattan Institute’s Balancing Budgets report, will involve tightening superannuation tax concessions and pension eligibility and abolishing negative gearing so that the tax burden is shared more fairly across the community and it becomes easier for our children to buy houses. These measures will all create space to reduce income tax and relieve the burden on low and middle-income earners.

The government has made one courageous decision in this budget: those born in 1965 will need to work until 70 to collect an Age Pension. This is the kind of measure that will both repair the budget in the long term and encourage economic growth. Future budgets will need more of this kind of courage if they are both to sustain the deficit reduction of this year’s budget and ensure long-run economic growth and well-being.