The Federal Government’s pre-election commitment to give bonus payments to aged-care workers is the equivalent of putting a Band-Aid on a broken bone. It is also a poorly designed policy.

We have criticised this commitment before, as have some others. Until now, the critics have essentially argued that the payments do nothing to overcome the systematic problem that aged-care workers get paid much less than workers doing less complex jobs in other industries.

Now, details have emerged which show that the payment rates are also inequitably designed.

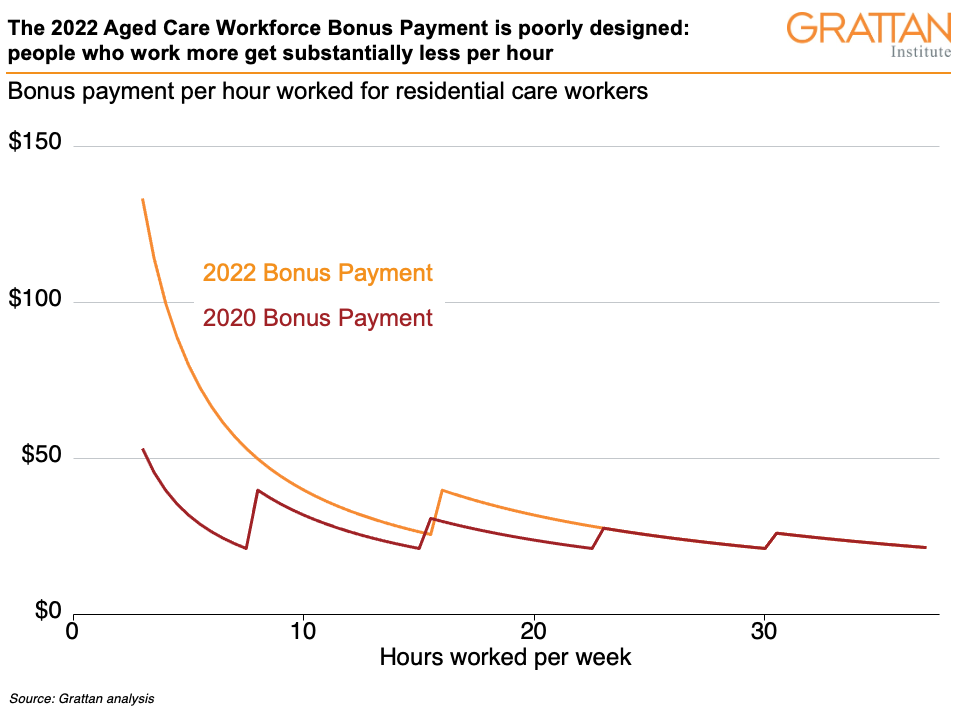

Logic would suggest that the payments should be pro-rated – a person working 50 per cent more hours should get 50 per cent more bonus payment. But this is not the case.

Unlike the 2020 Aged Care Workforce Retention Bonus Payments, which were better adjusted to the hours people worked, the 2022 bonus payment rates are in three broad tiers:

| Hours worked per week | Home Care | Residential Care |

| 3-to-15 | $300 | $400 |

| 16-to-30 | $480 | $640 |

| > 31 | $600 | $800 |

These rates are far from fair. As the chart below shows, the 2022 rates per hour are much higher for workers doing only a few hours per week than for full-timers.

Most aged-care workers are part time or casual. The 2020 Aged Care Workforce Census found that only 6 per cent of direct care workers in residential care were full-time, and only 12 per cent in home care.

Many aged-care workers work multiple jobs. It’s not clear yet whether they can get the bonus from multiple employers. But if they can, a person working a total of one day per week (7 hours) for three different employers, could end up with a $1,200 bonus – 50 per cent more than a person who works full-time for one employer. And enforcing a restriction that workers can only receive payment from a single employer may create an administrative nightmare.

Aged care also relies heavily on casual and contracted workers. About 20 per cent of direct care workers in residential care are casual or contracted, and about 40 per cent in home care. Yet it is unclear whether these workers will be eligible for bonus payments. If they are, it will be difficult to fairly determine their rates, because their work hours can vary from week to week.

And a final point: it will be very difficult for the Government to calculate how much it will need to spend on the bonuses, because that calculation relies on information on hours worked in multiple jobs – and the Government doesn’t have that information.

While you’re here…

Grattan Institute is an independent not-for-profit think tank. We don’t take money from political parties or vested interests. Yet we believe in free access to information. All our research is available online, so that more people can benefit from our work.

Which is why we rely on donations from readers like you, so that we can continue our nation-changing research without fear or favour. Your support enables Grattan to improve the lives of all Australians.

Donate now.

Danielle Wood – CEO