How Australia should fill dental and budget cavities

by Peter Breadon, Kate Griffiths

When the forerunner of Medicare was established in the 1970s, dental care was left out. Australians are still suffering the consequences half a century later.

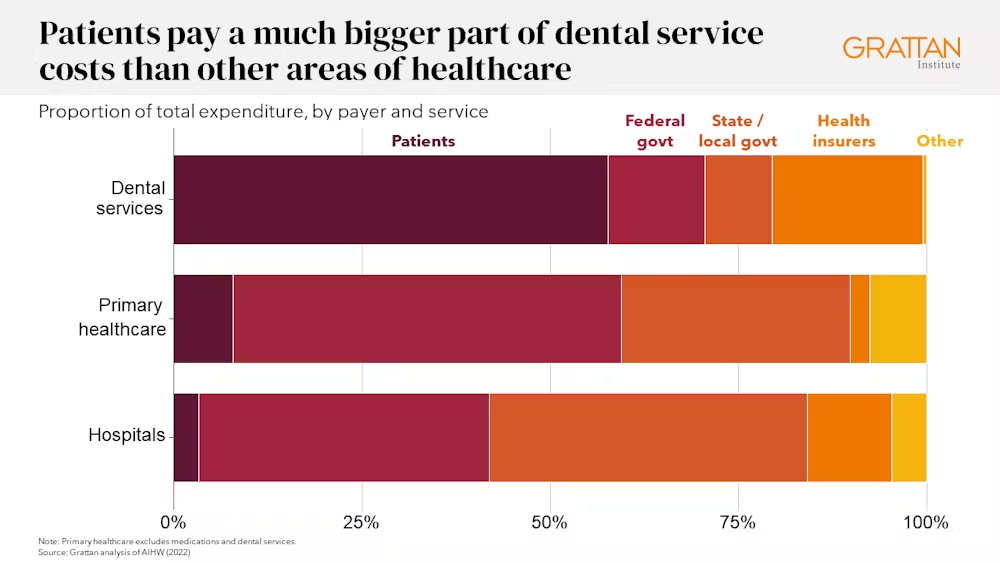

Patients pay much more of the cost of dental care than they do for other kinds of care.

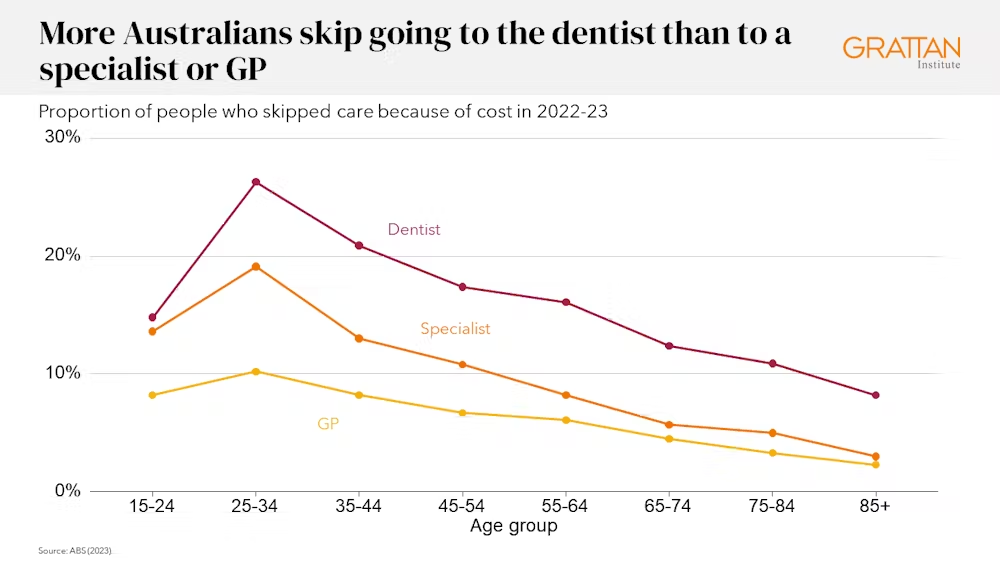

More Australians delay or skip dental care because of cost than their peers in most wealthy countries.

And as our dental health gets worse, fees keep on rising.

For decades, a litany of reports and inquiries have called for universal dental coverage to solve these problems.

Now, with the Greens proposing it and Labor backbenchers supporting it, could it finally be time to put the mouth into Medicare?

What’s stopping us?

The Australian Dental Association says the idea is too ambitious and too costly, pointing out it would need many more dental workers. They say the government should start small, focusing on the most vulnerable populations, initially seniors.

Starting small is sensible, but finishing small would be a mistake.

Dental costs aren’t just a problem for the most vulnerable, or the elderly. More than two million Australians avoid dental care because of the cost.

More than four in ten adults usually wait more than a year before seeing a dental professional.

Bringing dental into Medicare will require many thousands of new dental workers. But it will be possible if the scheme is phased in over ten years.

The real reason dental hasn’t been added to Medicare is it would cost billions of dollars. The federal government doesn’t have that kind of money lying around.

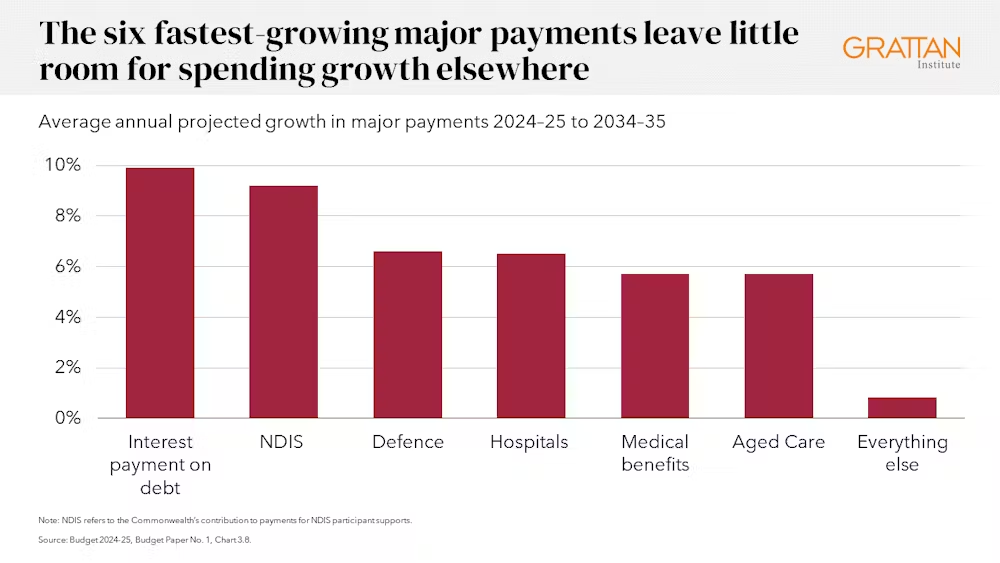

Australia has a structural budget problem. Government spending is growing faster than revenue, because we are a relatively low-tax country with high service expectations.

The growing cost of health care is a major contributor, with hospitals and medical benefits among the top six fastest-growing major payments.

The structural gap is only likely to grow without major policy changes.

So, can we afford health care for all? We can. But we should do it with smart choices on dental care, and tough choices to raise revenue and reduce spending elsewhere.

Smart choices about a new dental scheme

The first step is to avoid repeating the mistakes of Medicare.

Medicare payments to private businesses haven’t attracted them to a lot of the communities that need them the most. Many rural and disadvantaged areas are bulk-billing deserts with too few GPs.

The poorest areas have more than twice the psychological distress of the wealthiest areas, but they get about half the Medicare-funded mental health services.

As a result, government money isn’t going where it will make the biggest difference.

There are about 80,000 hospital visits each year for dental problems that could have been avoided with dental care. If there is too little care in disadvantaged and rural communities, where oral health is worst, that number will remain high.

That’s why a significant share of new investment should be quarantined for public dental services, with those services targeted to areas where people are missing out on care.

Another problem with Medicare is its payments often have little relationship to the cost of care, or the impact that care has on the patient’s health.

To tamp down costs, Medicare funding for dental care should exclude cosmetic treatments and orthodontics. It should be based on efficient workforce models where dental assistants and therapists use all their skills – you might not always need to see a dentist.

The funding model should take account of a patient’s needs, reward giving them ongoing care, and have a cap on spending per patient.

Oral health should be measured and recorded, to make sure patients and taxpayers are getting results.

Tough choices to balance the budget

Those steps would slash the cost of The Greens’ plan, which is hard to estimate but might reach more than $20 billion a year once it’s phased in. Instead, the cost would fall to roughly $7 billion a year.

That would be a good investment. But if you’re worried about where the money will come from, there are good ways to pay for it.

Many reforms could reduce government health budgets without harming patients.

There is waste in government funding of pathology tests and less cost-effective medicines.

In some hospitals, there are excessive costs and potentially harmful low-value care.

Over the longer-term, investments in prevention can reduce demand for health care. A tax on sugary drinks, for example, would improve health while raising hundreds of millions of dollars a year.

Measures like this would help the government pay for more dental care. But demand for health care will keep growing as the population ages, and as expensive new treatments arrive.

This means a broader strategy is needed to meet the three goals of balancing the budget, keeping up with growing health-care demand, and bringing dental into Medicare.

There are no easy solutions, but there are many options to reduce spending and boost revenue without hurting economic growth.

Choosing Australia’s infrastructure and defence megaprojects more wisely could save several billion dollars each year.

Undoing Western Australia’s special GST funding deal – described by economist Saul Eslake as “the worst Australian public policy decision of the 21st Century thus far” – would save another $5 billion a year.

Reducing income tax breaks and tax minimisation opportunities – including by reining in superannuation tax concessions, reducing the capital gains tax discount, limiting negative gearing, and setting a minimum tax on trust distributions – could raise more than $20 billion a year.

Major tax reform like this offers economic benefits while creating space for better services such as universal dental coverage.

No one likes spending cuts and tax hikes, but they will be needed sooner or later regardless. Dental coverage might be just the sweetener taxpayers need to accept it.