Economic theory might actually be right: Markets are surprisingly efficient at driving innovations and reducing costs – even to reduce pollution – provided there is a clear price signal as an incentive.

A Grattan Institute study released this Wednesday (15 December), Markets to Reduce Pollution: Cheaper than Expected, reviews actual price and trading history compared to original forecasts, across six markets aimed at reducing pollution and promoting cleaner sources of energy in Australia, the United States and Europe. It finds that government and other experts consistently underestimated how much industry innovates and adapts. As a result government targets to reduce pollution were regularly achieved faster, and at lower cost than originally expected. It also finds that experts were routinely wrong in their predictions about which particular measures would be the lowest cost.

This history has lessons for policy-makers looking to reduce emissions in Australia:

- It reinforces with practical experience that we should use broad-based pricing schemes that minimise government actively choosing in advance which projects and technologies to reduce

- It suggests that any emissions trading scheme should be supplemented by a carbon tax to provide a floor on carbon

If it turns out to be cheap to reduce pollution, a floor price automatically further reduces total pollution. If governments think that reducing pollution will be expensive, they worry about the impact on the economy, and set relatively weak targets. If the economic cost of reducing emissions is less than expected – and this happened in all the schemes reviewed – then a floor price effectively tightens the pollution target.

This reduces total pollution towards the target that government would have set if it had known that reducing pollution would be cheap. Our article, Best of both worlds? (published in Climate Spectator in October), elaborates on the other advantages of a floor price for carbon.

Three of the six markets examined in the report are outlined below. All six markets followed a similar pattern: Government tends to set targets and regulatory controls responding to concerns that reducing pollution will be expensive, when in practice it usually turns out to be cheap.

US SO2 Trading

In the world’s first emissions trading scheme, the United States tried to reduce Sulphur Dioxide emissions from coal-fired electricity generation. Emission allowances traded at prices considerably below initial forecasts. This occurred not just over the first phase from 1995 to 2000, but also under the considerably tightened cap introduced in 2000.

Figure 1 – SO2 allowance price (tonne SO2)

Source: US EPA

Source: US EPA

At first, power stations used more coal with low sulphur content, rather than following the expectations of forecasters that they would install scrubbers (that strip sulphur dioxide from the exhaust stream).

Low sulphur coal reduced pollution at much lower cost than forecast. After the scheme had been operating for a while, power stations started to install scrubbers – which turned out to be cheaper to install and more effective at reducing pollution than forecasters had predicted.

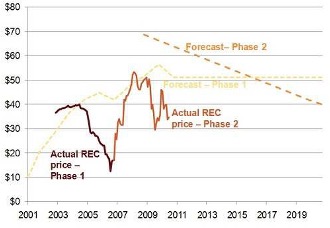

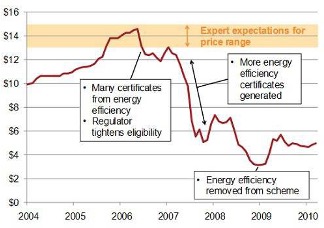

NSW Greenhouse Gas Abatement Scheme

In the world’s first carbon trading scheme, the NSW Greenhouse Gas Abatement Scheme, the price of abatement certificates plummeted in 2006 as residential energy efficiency actions generated a flood of abatement certificates. Again this was not foreseen by many energy experts such as ACIL Tasman, Energy Australia, and the National Institute of Economic and Industry Research, who had prepared forecasts for government bodies.

Figure 2 – NSW GGAS abatement certificate prices ($/NGAC)

Source: IPART

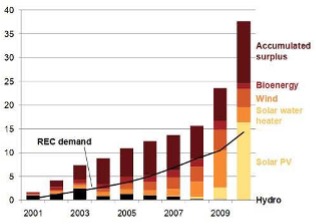

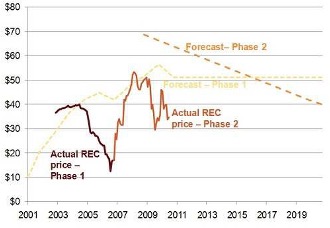

Australian Mandatory Renewable Energy Target

Under Australia’s Renewable Energy Target prices collapsed on two separate occasions because government and forecasters underestimated how market participants would respond.

Government expected that bioenergy (particularly burning sugar cane waste) would dominate the first phase of the scheme. However, forecasters failed to anticipate that wind, solar water heaters and hydro would turn out to be much cheaper than bioenergy. These technologies led to a large surplus of certificates by 2006. In the second phase of the scheme, government expected that wind would contribute much of the increased renewable energy supply. But in practice, solar water heaters and solar photovoltaics boomed over 2009 and 2010 due to a variety of reasons, including a halving in the price of solar PV systems. Even though government substantially increased the renewable energy target, the market continues to have many excess certificates.

Figure 3 – REC demand and sources of supply, 2001-2010 (millions of RECs)

Sources: www.rec-registry.gov.au; Green Energy Markets

In the first phase, prices plummeted from $40 per certificate to less than $20, when the government- commissioned forecast was for them to steadily rise to above $50. In the second phase certificates were expected to reach $70, but plummeted after reaching a nadir at around $50.

Figure 4 – Actual REC prices versus forecasts ($/REC)

Sources: McLennan Magasanik & Associates for forecasts; Green Energy Markets for actual REC prices

When the same outcome emerges from one scheme after another, we are entitled to suspect that there might be a pattern, driven by underlying economic and political fundamentals.

Governments are always reluctant to assume in forecasts that there will be innovation that can’t be identified and predicted in advance. Markets participants, when they have incentives to reduce pollution, are always keen to innovate to reduce costs in new ways.

The good news is that experience suggests that reducing pollution will be cheaper than we expect – provided that we have the courage to put in place market structures to encourage innovation.