Published in PointCarbon, July/August 2010

Like many countries, Australia has engaged in a heated debate around whether it can afford to price carbon emissions before a global scheme is in place. With the UN climate change conference in Copenhagen last December unable to reach a binding international agreement, this debate continues in Australia now that the government has reversed its previous policy and deferred consideration of an emissions trading scheme (ETS) until at least 2012.

The touchstone concerns in the Australian debate have been:

The analysis shows that even large percentage changes in energy prices have only limited effects on overall household expenses

- Carbon pricing will substantially increase the price of energy, inflicting real suffering on less well- off households; and

- carbon pricing will shut Australian industries, resulting in massive job losses at home, and encouraging production to move overseas to countries like China, with worse

These concerns are superficially plausible. A study* at Grattan Institute tested whether the evidence supported them. After analysing the impact of carbon pricing on households and the competitiveness of individual industry facilities, we found, for the most part that these concerns were misplaced.

These issues have been examined before by the government’s Treasury Department, the national science academy Commonwealth Scientific and Industrial Research Organisation’s (CSIRO’s) Energy Futures initiative, and the state governments’ Emissions Trading Task Group. However, the reassuring conclusions of these complex modelling exercises had limited impact on the public debate among the media, general community and their political representatives.

While the general equilibrium modelling of these prior studies is intellectually rigorous, it has limits. People outside the modelling community do not know how the models come to their conclusions. Most people view them as black boxes whose answers ask to be taken on trust. While the Australian people generally trust institutions such as the Treasury and CSIRO, they are understandably sceptical of opaque methods. When vested interests contradict the models and claim we face an imminent ‘economic disaster’, it is easy and understandable to prefer the status quo.

Our study took a different, complementary approach. We examined the direct impact of carbon pricing on costs, and the resulting changes to industry cost curves, assuming a carbon price in Australia, but no change elsewhere.

It aimed to make the analysis as tangible and intuitive as possible.

- Focussed on the effect of a carbon price just until 2020. Targets in 2050 may be the ultimate end point, but they are too far in the future for most people to worry about;

- used a constant carbon price of A$35 (US$30) per tonne of carbon dioxide rather than a range of prices over time. The Australian Treasury modelling suggested that a price of A$35 would result

from a 5% cut in emissions from 2000 levels by 2020 – an unconditional target that is official policy of both sides of the political divide in this country. Many companies use a A$35 price as the ‘base case’ in their modelling. A constant price provides results that are easier for people to understand, and it is relatively easy for readers to multiply the results to construct their own sensitivity analysis;

- tried to analyse the impacts on individual Australian facilities that industries claimed were most at risk from a carbon price. This revealed a number of situations where the facility most at risk from a carbon pricing was in fact more profitable than the average of its peers;

- wherever possible used the financial, market and emissions data published by the actual companies that owned the facilities thought to be at risk. This is less open to dispute than broad- based assumptions derived from macro-economic statistical data;

- constructed industry cost curves to present graphically in a single picture both the position of Australian industry relative to global peers, and the impact of a carbon price;

- looked at the actual carbon emissions of facilities overseas to which production was most likely to move, rather than simply assuming that emissions would be worse if Australian facilities closed; and

- compared the impact of carbon pricing with other Australian economic reforms over the last two decades to help people understand its impact by reference to changes they had already

So what did we find?

Households

To calculate the impact on households, we simply took the current emissions intensity of Australia’s gas, electricity and petrol and then assumed all of the carbon liability would be passed through to end consumers. As figure 1 shows, carbon pricing has a relatively small impact on Australian households’ overall budgets.

Direct energy expenditure is a much smaller fraction of household budgets than many people assume, and consequently even large percentage changes in energy prices have only limited effects on overall household expenses.

Industry

Carbon pricing is only a competitiveness issue for the minority of industries that meet both of the following conditions:

- They are exposed to competition from countries that do not have a carbon pricing scheme; and

- they have high emissions relative to their revenue – that is to say, they are ‘emissions intensive’ – so that carbon pricing might materially alter their cost

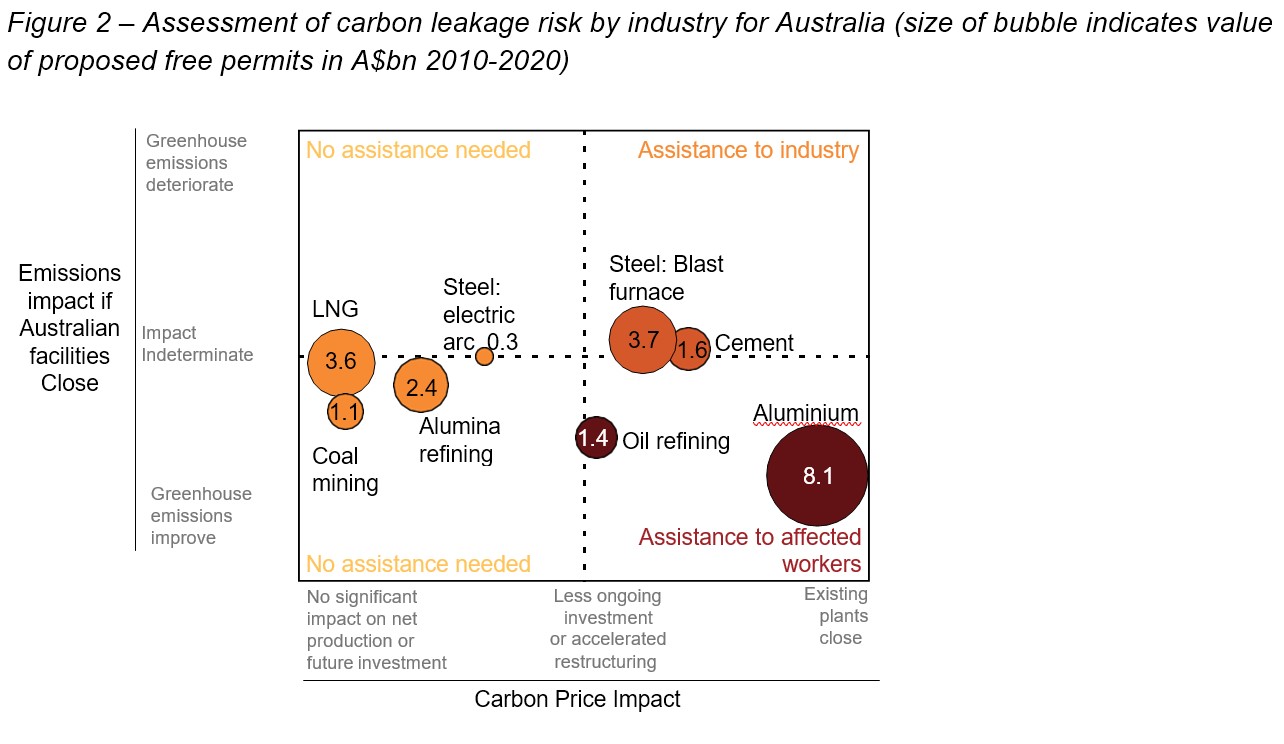

At least one of these conditions does not apply to over 90 per cent of Australian industry, whose competitiveness is, therefore, not affected by carbon pricing. Of the remaining industry, we analysed seven of the biggest emitters of greenhouse gases (GHGs) in Australia – steel, cement, aluminium smelting, alumina refining, oil refining, coal mining, and liquefied natural gas production (LNG) – which collectively produce over one fifth of Australia’s GHG emissions.

We found that coal mining, alumina refining and LNG production would continue to be internationally competitive, and consequently did not require any industry assistance from government, such as free allowances.

We assessed the cash costs of Australian coal mining and alumina refining facilities relative to plants overseas using international cost curves published by the major resource companies in investor presentations. These indicated that Australian facilities were some of the lowest cost in the world.

Even after adding a carbon cost consistent with their emissions intensity, they would remain low-cost producers. The proposed A$3.5 billion in free permits from 2010-2020 was not necessary to keep them in production

Oil and gas equity analysts have estimated the break-even economics of a range of Australian LNG projects in development. To provide a 12 per cent return on capital requires a gas price per million British thermal units (mmBTU) of between US$6 to US$8. We estimated that carbon costs would only change this price by around 20 to 30 cents.

By way of comparison, presentations to investors by two of the major Australian LNG developers outlined their expectations of robust LNG pricing outcomes with long-term contract pricing around US$12 per mmBTU at an oil price of $80 per barrel (the price expected under base case forecasts from the International Energy Agency and US Energy Information Agency – the statistical arm of the Department of Energy). Furthermore, the increase in costs due to carbon pricing was small relative to the uncertainties inherent in LNG development, such as future oil prices and construction cost increases. We estimated that the LNG industry would receive A$3.6 billion in industry assistance to 2020 under the government’s proposed emissions trading legislation – assistance it did not need, for facilities that in general have not yet been constructed.

We found that aluminium smelting and oil refining might well shut Australian facilities due to a carbon price. However, this is environmentally desirable because their output is likely to be replaced by facilities overseas with substantially lower GHG emissions intensity. Arguments that aluminium smelting capacity would be replaced by emissions-intensive Chinese production are implausible in the medium term given the public statements of Western producers that they are mainly planning low emissions facilities, and reports that the Chinese government is restricting the country’s aluminium production because it consumes scarce and expensive Chinese electricity.

With a global carbon price, the Australian facilities are unlikely to be internationally competitive. The AU$9.5 billion in free permits we estimated they would receive to 2020 would delay restructuring the Australian economy to be more competitive in the carbon constrained world of the future. We argue that Australia should start restructuring its economy sooner rather than later because its starting position is behind the rest of the world: Australia has the highest emissions per capita and per unit of GDP in the developed world.

Around 11,000 people work in these facilities, around one tenth of the jobs lost as Australia removed tariff barriers for manufacturing, and one tenth of the jobs lost as Australia restructured its electricity sector. Job losses on this scale are well within the capacity of government to provide adjustment assistance. It is better for government to support workers directly by assisting them to obtain alternative employment in places with a more sustainable future, rather than paying companies to continue employing workers in industries with a limited outlook.

We found that undesirable carbon leakage was possible for steel and cement clinker. A carbon price would make some Australian facilities marginal, and production from overseas would not have substantially lower emissions. However, rather than providing free permits as proposed by the government, it would be better to apply border adjustments.

Australian cement and steel producers would be required to purchase all their permits rather than receive some for free. Steel and cement clinker importers would make an equivalent payment, based on Australian industry average emissions, effectively levelling the playing field. Importers would be able to reduce this payment, by demonstrating that either their actual production emissions were lower, or they had already paid a carbon price in their ‘home’ country. A border adjustment would be better than free permits because it would increase the price of carbon intensive materials to reflect the full cost of carbon, encouraging greater efficiency in their use, more use of lower emission substitutes, and lower emissions production. Free permits would mute these economic changes.

However, we would caution against border adjustments for all industries – effectively a consumption- based carbon price. Under a general scheme, there would be no cost for carbon emitted in producing exports. Consequently there would be little incentive to reduce emissions from facilities focused on production for export. Calculating the emissions intensity for every imported and exported product would be administratively expensive. By contrast, our proposal targets just two industries where carbon leakage is a significant possibility, without imposing significant burdens and disincentives on the remainder of the economy. As our overall analysis demonstrates, carbon leakage is a relatively rare phenomenon in reality, and consequently should be treated as an exception to scheme design rather than a driver of its architecture.

Conclusion

Figure 2 summarises our overall findings on industry impacts and carbon emissions. Those industries on the left will remain competitive with a carbon price, and large-scale closures are unlikely. Those in the bottom right are probably not sustainable in the long-run as they are substantially more polluting than competitors overseas. Assistance in such cases should be targeted to workers rather than supporting ongoing production. Those towards the top right may experience perverse outcomes, and border adjustments should prevent undesirable shifts in production due to inadequate carbon emission controls overseas.

Overall, our research suggests that Australia can afford to place a price on carbon, even without a comprehensive global treaty. The burden on households is moderate and can be easily mitigated through adjustments in other taxes or cash transfer. The burden on industry and impact on employment is small. Examining the detailed evidence shows that carbon pricing in Australia is a manageable change.