Published at The Conversation, Tuesday 8 March

After Labor announced proposed changes to negative gearing and the capital gains tax discount, Prime Minister Malcolm Turnbull told parliament that the policy would

administer two contradictory shocks, massive shocks, to the residential housing market. They are proposing to remove from the market for established dwellings one-third of demand. All investors would be gone. When I say all investors, I mean all investors.

That assertion was questioned by some listeners at the time, including The Guardian’s Katharine Murphy.

Does the prime minister’s claim stack up?

Not all property investors negatively gear

Data is not directly available on what proportion of home purchases are made by investors. Data on new home lending from The Australian Bureau of Statistics’ Lending Finance figures indicates that between one-third and half of new lending is to investors. And ABS census data shows that just under a third of existing properties are owned by investors.

But not all of them negatively gear. Some do not borrow, and others do not borrow enough to be negatively geared: that is, their rental income is greater than the expenses and loan interest. The tax stats show us that about two-thirds of all housing investors are negatively geared. This suggests that around 20% of housing buyers are negatively geared investors.

Investor demand for housing will reduce – but not disappear

Labor’s proposed changes will reduce the after-tax returns on property investment.

Although negative gearing has attracted more attention, Labor’s proposed changes to capital gains tax will have a bigger impact on returns. Reducing the discount from 50% to 25% will increase the effective tax rates on capital gains, bringing the tax rates closer to those that apply to other sources of investment income such as rental income and bank interest.

Labor’s proposed changes to negative gearing will also have an impact. Under the policy, investors who make rental losses – because their rental income is less than their costs, including loan interest costs – will no longer be able to write-off those losses against wage and salary income. But for people investing in new housing there will be no change: they will still able to write-off losses against all forms of individual income.

For most investors in existing properties, the changes to negative gearing mainly affect the timing, not the amount, of tax deductions. Losses can still be deducted against investment income, including subsequent capital gains. But negative gearing may lose some of its psychological appeal. While there is no hard research for Australia, some investment advisors have warned against placing too much emphasis on tax breaks (particularly tax breaks on wages) and not enough on the financial returns to the investment.

Together these policies will reduce investor demand for housing. Indeed, one of Labor’s stated aims of the policy is to make it easier for first home buyers to get into the market.

Some investors will switch to other investment opportunities that offer higher post-tax returns. Others might choose to spend more and invest less. But some will also continue to invest in the housing market, and either borrow less, or simply accept a lower return on investment.

The extent to which investors will vacate the property market will ultimately depend on how much post-tax returns fall, and how sensitive is investor demand for property to changes in returns (what economists would call the “elasticity of demand”).

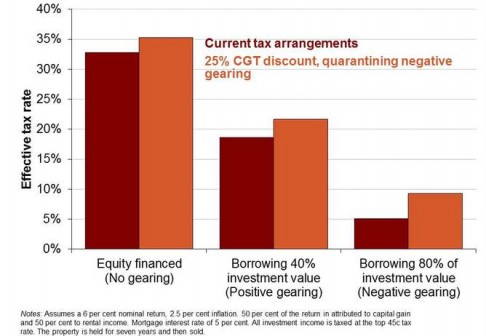

Our estimates suggest that the changes in effective tax rates from Labor’s policy are relatively modest.

Consider an investor in the top tax bracket, paying 45 cents in the dollar on their marginal income and earning a 6% nominal return on their property (half from rental income, half from capital gain). Let’s say the investor buys a property and then sells it after seven years.

Effective tax rates calculate how much tax is paid on the profit made by the taxpayer. If the investor buys the property outright, the effective tax rate will increase from 33% to 35% under Labor’s policy. If the same investor borrows 40% of the house value then effective tax rates increase from 19% to 22%. And for a negatively geared investor borrowing 80% of the property value, the effective tax rate changes from 5% to 9%.

And any changes in post-tax returns under Labor’s policies may be swamped by annual fluctuations in property prices. As the Commonwealth Bank of Australia Chief Executive Ian Narev recently noted:

I can tell you having a $400 billion home loan book – your assumptions on unemployment and what’s happening in global interest rates will dwarf whatever assumptions you’ve got on the modelling about the impact of negative gearing by a factor of… I can’t tell you the number but it’s a big number.

A massive shock?

Under Labor’s policy, other passive investments that generate capital gains, such as shares, will also be subject to a more stringent tax treatment. Other investments that will be relatively more attractive after the change – for example, superannuation and bank deposits – have a very different profile of risk, return and liquidity.

No-one can ever perfectly predict investor behaviour. Ultimately, there are a whole host of factors that people take into account when investing in property, including rental returns (particularly for the one third of positively geared investors), risk perception, familiarity with the asset class and ability to obtain bank finance. In our opinion, modest changes in tax treatment are unlikely to change the decision-making calculus for the majority of investors.

Indeed, looking at other countries with less generous tax treatment for investment properties – US, Canada, Germany and France, for example – there is still plenty of investor activity in housing.

Given the evidence we have seen, it is overreach for the prime minister to say that Labor’s policy will drive away all investors.

![]()