Private health insurance death spiral continues

by Stephen Duckett

The private health insurance regulator released new statistics on health insurance uptake last week. On the face of it, the headline number looks good: an increase of 46,000 people insured during the June quarter 2021, and almost 250,000 more people insured at the end of the June quarter 2021 compared the June quarter 2020.

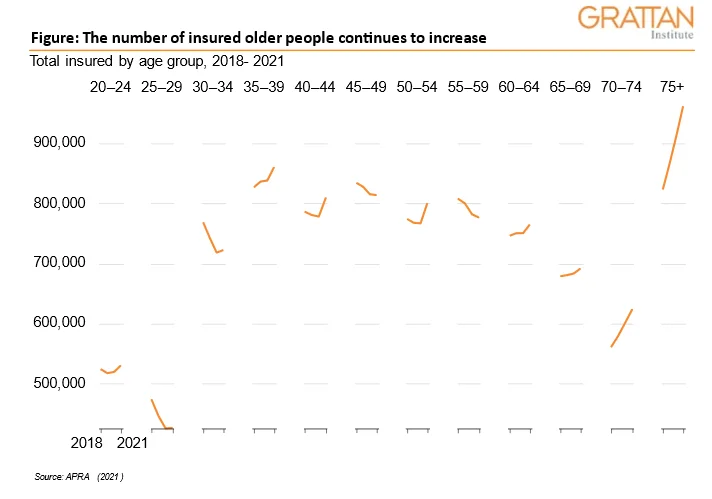

But if we look behind the headline statistics, the numbers are not good. The graph shows the change in membership of health funds by age group.

There are two notable conclusions to be drawn from the graph. First, the number of Australians aged 60 and above who have private health insurance has gone up in every age bracket. The patterns for people aged between 30 and 60 is less clear.

While there has been a reversal of a longer-term downward trend in this past year – with an increase of more than 80,000 newly insured in this age group – overall, there are fewer people insured in this age group compared to three years ago.

That’s a problem for private insurers because it’s people over 60 who generally draw on their insurance, while people under 60 generally contribute to the pool.

So, it is not a good sign when the number of people drawing insurance goes up, and the number contributing doesn’t.

Incentives fall flat

Which brings us to the second issue of note: what’s happening with people in the 20-30 year age group.

This group has been the target of a number of policy initiatives in recent years, including allowing them to stay in their parents’ insurance while they live at home, and allowing insurers to give them discounts.

But the impact of these incentives appears to have been marginal. There are roughly the same number of 20 to 30-year-olds insured in the June quarter 2021 as the same time last year (a one percent increase), but 2021 numbers are down four percent on 2018.

Grattan Institute has released three reports on private health over the last two years which argue that the way to address the ‘death spiral’ — of declining interest by young people in private insurance, forcing up premiums for those who remain, causing more to drop out and so on — is to improve the product not increase subsidies. (You can read the reports here, here and here.)

Patients stay longer in private hospitals than public hospitals. Premiums could be reduced with restructured private hospital pricing to discourage long stays.

Prices paid for prostheses in private hospitals are significantly higher than public hospitals pay for the same prosthesis — another potential source of savings.

Cut excess fees

A handful of greedy doctors charge more than twice the Medicare Benefits Schedule fee — and this six percent of doctors account for more than 90 percent of excess fees. Getting rid of those excess fees would also improve the product. And insurers shouldn’t be let off the hook either — some give back less than 85 percent of premium revenue in benefit payments.

All the industry players have to acknowledge that the industry needs to become more efficient to drive premiums down. The latest industry statistics shows that the industry’s problems won’t go away with wishful thinking.

The private health insurance death spiral continues.

While you’re here…

Grattan Institute is an independent not-for-profit think tank. We don’t take money from political parties or vested interests. Yet we believe in free access to information. All our research is available online, so that more people can benefit from our work.

Which is why we rely on donations from readers like you, so that we can continue our nation-changing research without fear or favour. Your support enables Grattan to improve the lives of all Australians.

Donate now.

Danielle Wood – CEO