The 2022 federal Budget lays out some handy treats for motorists. And there’s no doubt that halving the fuel excise will ease the pressure of petrol costs for many Australian families. But how much is the Federal Government spending to ease fuel prices, and who will benefit from the tax cut?

Every time Australians buy petrol, we contribute to the Federal Government’s coffers. On the day of the federal Budget, Australians paid 44.2 cents in fuel excise per litre of fuel. But for the next six months, from now until September 28, Australians will pay half that rate.

Many economists have put forward arguments against the fuel excise tax cut. A major concern is the cost. Despite only lasting 6 months, the Government expects the fuel excise reduction will cost a whopping $3 billion in lost revenue.

$3 billion is not small change. It’s almost as much as the total promised Budget spend in NSW on infrastructure projects, and about twelve times larger than the Federal Government’s electric vehicle plan, the ‘Future Fuels Fund’.

And if the winner of the next election is pressured to extend the cuts beyond September to avoid the optics of a ‘tax hike’, the costs to government will only rise.

But who will benefit from the fuel excise reduction?

In his Budget speech, the Treasurer emphasised that the cost-of-living packages announced were ‘targeted’, designed for maximum impact and to ease the hip pocket of those who need it most. And in a sense, this is true. Most of the handouts in the federal budget are aimed at goods such as fuel, which are at particularly high prices, or toward people earning lower incomes.

But even if the government is convinced that cost of living pressures need to be addressed, cutting the fuel excise is a bad way to go about it, because it is skewed in favour of those who earn more.

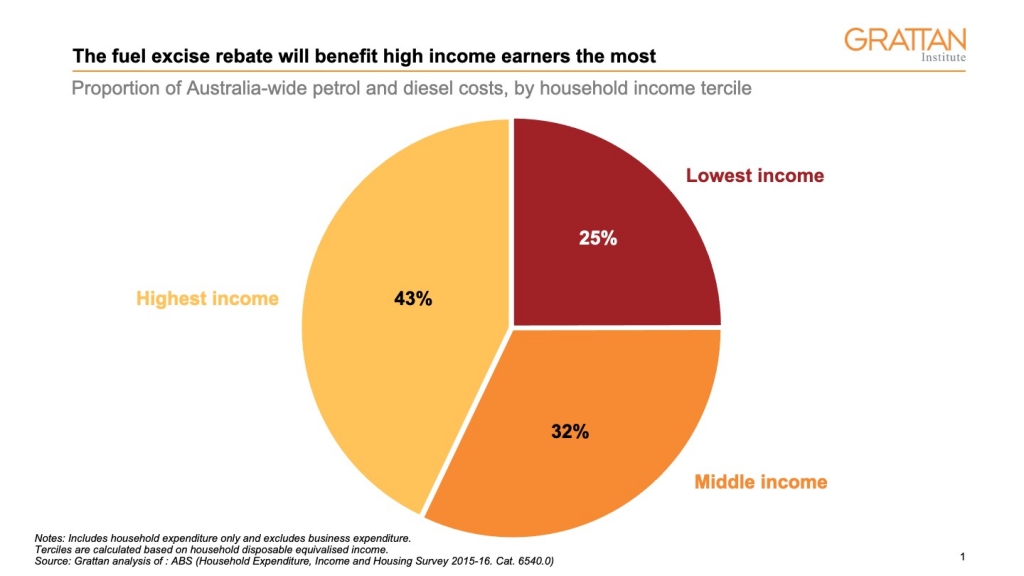

According to the most recent household expenditure and income survey, 43 per cent of all petrol and diesel costs are incurred by the third of households on the highest incomes. Thirty-two per cent of petrol and diesel is bought by households with the middle third of incomes, and the households earning the lowest third of incomes account for 25 per cent of petrol and diesel expenditure.

The result is that the government’s $3 billion dollar initiative will benefit high income households far more than it will benefit the households who need it most. Of the foregone revenue, highest-income households will receive about $1.3 billion, middle-income households about $0.95 billion, and lowest-income households only $0.75 billion.

Of course, averages hide a lot of variation – there are certainly lower income households that drive long distances, and higher income households that don’t.

But tax policy that provides handouts to higher-income Australians is unlikely to be well ‘targeted’ policy that helps ease cost of living pressures for those who need it the most.

While you’re here…

Grattan Institute is an independent not-for-profit think tank. We don’t take money from political parties or vested interests. Yet we believe in free access to information. All our research is available online, so that more people can benefit from our work.

Which is why we rely on donations from readers like you, so that we can continue our nation-changing research without fear or favour. Your support enables Grattan to improve the lives of all Australians.

Donate now.

Danielle Wood – CEO