Competition is critical on infrastructure megaprojects

by Marion Terrill

Australian construction firms have been squeezed out of big government projects by large multinationals, according to Deputy Prime Minister Barnaby Joyce.

He wants projects split into smaller packages so Australian-owned mid-tier firms can get a bigger piece of the action in the current record infrastructure spend.

But the fact is that mid-tier firms have been getting a substantial share of work on government megaprojects – the infrastructure boom has meant there’s more for everyone. Rather than favouring one segment over another, governments should focus on procuring public infrastructure at the lowest long-term cost to taxpayers.

Australia’s governments are certainly spending big on infrastructure. When the pandemic struck in March 2020, the value of the road and rail projects being built across the country exceeded $120 billion for the first time. Not only was the amount of work at an all-time high, so was the size of projects being built. It is no longer true that only a couple of very large projects are being built at any one time; now, most of the work being done is on ‘megaprojects’ – those costing $1 billion or more. In fact, Australia has entered an era of mega megaprojects, with most work being done on projects with an expected cost of more than $5 billion.

Few locally-based engineering construction firms have the expertise and balance sheet to tackle projects worth $1 billion or more; those that can are known as ‘tier one’ firms. Three tier one firms operate in Australia today: CPB Contractors, John Holland, and Acciona. Historically, there have generally been two or three such firms active at any one time. There are many more mid-tier firms: tier twos, able to take on contracts up to about $500 million without a joint venture partner, and tier threes, able to take on contracts of less than $100 million.

The Deputy PM is not alone in thinking that domestically-owned firms need a leg-up. A lobby group, Australian Owned Contractors, has been formed to argue that locally-owned mid-tier firms are being locked out of the market by foreign-owned tier one firms. Australian Owned Contractors claim it’s no good for competition or for the Australian taxpayer for foreign-owned tier one firms to win as much megaproject work as they currently do.

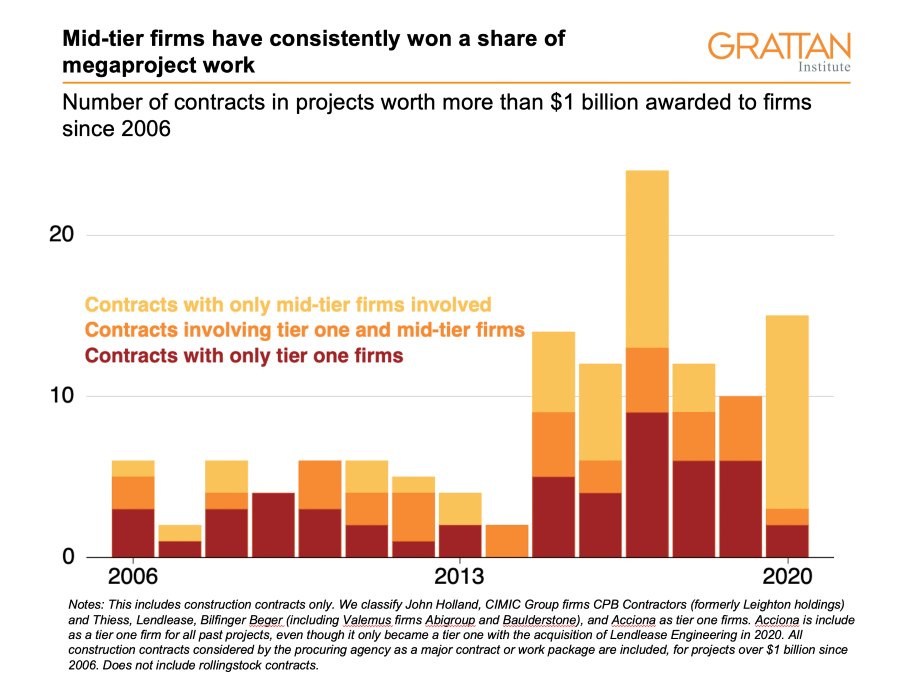

It’s true that tier one firms often win government megaproject work in Australia. But mid-tier firms also have a history of winning megaproject work. In fact, mid-tier firms won 31 per cent of the contracts for megaproject work over the past 15 years without the involvement of a tier one firm. Tier one firms won 27 per cent in joint ventures with mid-tier firms, and 41 per cent without.

All the same, the world is changing. With the rapid recent growth in very large projects, the size of contracts has also grown. The average $1 billion-plus project is divided into two or three contracts, and the typical $5 billion-plus project is divided into four or five. It’s no longer a rarity for a single contract on a megaproject to be worth more than $2 billion, and even as much as $4 billion or $5 billion.

The growth in average contract size calls into question how many firms can feasibly bid for such work. Even though mid-tier firms can and do win megaproject work, they do not bid for the very largest contracts without partnering, typically with a tier one firm. Once contract size exceeds about $3 billion, even tier one firms tend not to take them on without entering into a joint venture with another tier one firm. An example is the Rozelle Interchange project in NSW, which initially attracted only one bidder – a joint venture between the big three firms.

Taking on contracts worth more than $3 billion or so demands considerable technical and financial capability. And the Australian market can sustain only so many players. But potential competition has a role to play too. Even if only a handful of firms or consortia bid on a particular project, the prospect that other firms could bid, or could enter the market for future work, dampens the enthusiasm of the few actual bidders to propose too high a price.

Industry lobbyists continue to argue that big projects should be split into smaller ones, so that more firms can compete. And they have a point; bundling projects up into ever bigger packages comes with all sorts of risks. But splitting projects comes with a different set of risks; managing the interfaces between works packages is complex and difficult, and there are times when it simply doesn’t make sense to carve up a megaproject.

Politicians and bureaucrats should not waver from the job of delivering public infrastructure at the lowest long-term cost to taxpayers, for a given quality standard. More competition from qualified and skilled firms should be welcomed and encouraged; firms that have succeeded elsewhere in the world can bring global innovation and know-how to Australia. Robust competition helps keep construction costs down and encourages all firms to innovate.

Australia’s governments should ensure that the interests of the community prevail over the concerns of any particular segment of the engineering construction industry.

While you’re here…

Grattan Institute is an independent not-for-profit think tank. We don’t take money from political parties or vested interests. Yet we believe in free access to information. All our research is available online, so that more people can benefit from our work.

Which is why we rely on donations from readers like you, so that we can continue our nation-changing research without fear or favour. Your support enables Grattan to improve the lives of all Australians.

Donate now.

Danielle Wood – CEO