Published at The Conversation, Tuesday 17 December 2013

The mid-year budget update released on Tuesday — known as MYEFO — largely tells close observers what they knew already. The Commonwealth budget doesn’t add up. Revenues don’t cover outgoings. The numbers won’t improve much with time. Even a passable budget result requires government to cut costs in ways they haven’t been cut for more than a decade. And it’s hard to see the numbers adding up without tax increases somewhere.

Of course, with a new government, there are variations. There is more rhetoric about an “unsustainable fiscal position”. At least this is a start – communicating to the public that there is a problem is a vital first step in budget repair.

This year’s deficit is revised to worsen by A$17 billion. Almost A$9 billion of this is the one-off grant to the Reserve Bank, which won’t recur in future years. Another A$4 billion is the result of a miscellany of spending decisions. And an additional A$4 billion is due to lower income, mainly lower income taxes.

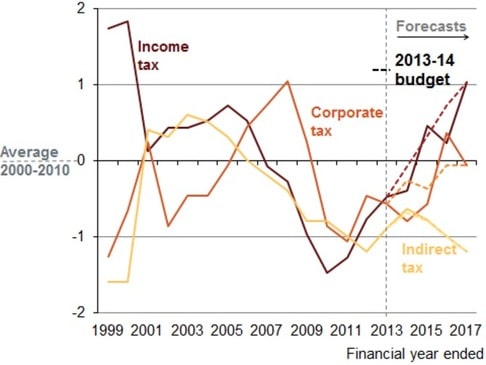

Future budgets have also been revised downwards. Next year, the government has written off over A$5 billion in personal income tax receipts and another billion in company tax. Add this to the elimination of carbon tax revenues and other recent changes, and the government is expecting tax receipts in 2014-15 to be A$9 billion less than previously forecast. However, the changes to long-run trends are not particularly substantial, as shown in Figure 1.

Figure 1: Tax revenues as a percentage of GDP relative to their average 2001 – 2010

Grattan 2013

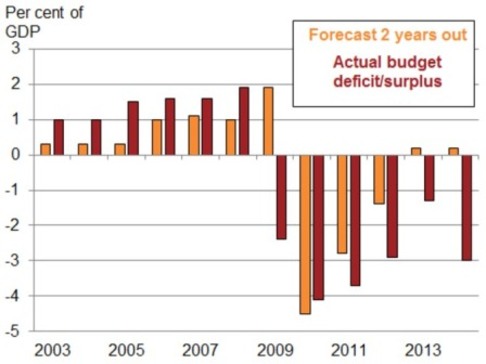

These revisions do suggest the 2013-14 budget outcome will be materially worse than earlier forecasts. This continues a well-established trend. Of the last six budget outcomes, all bar one were more than 1% of GDP worse than forecast two years beforehand. At least the current forecasts now seem to err on the pessimistic rather than the optimistic side. They now incorporate more detailed modelling of mining prices, and more realistic unemployment outcomes. This is good economics, and sensible politics. People remember Wayne Swan for getting it wrong on the downside, but not Peter Costello for getting it wrong on the upside.

Budget deficit and surplus relative to forecast two years out. Adapted from Grattan (2013)

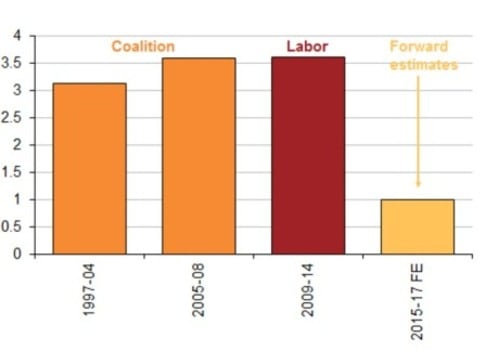

Another positive development is more realistic commentary about cost growth. Previous budgets forecast that cost growth for 2015-17 would be much lower than over the last decade. The Howard government averaged over 3% per year. The Rudd-Gillard government – from the pre-GFC budget in 2007-08 to the post GFC budget in 2013-14 – had cumulative average cost growth of 3.5%. It then projected around 1% cost growth for each of the following three years.

Although this was apparent from previous budget papers (as we highlighted in May), Treasurer Hockey’s statement highlighted how it implies hard cuts to spending in order to allow some categories, particularly health, to grow in line with demand.

Growth in real government expenditure over past governments. Grattan Institute (2013)

But it’s not yet clear everyone in the government is singing from the same hymn sheet. The prime minister appears to believe economic growth can substitute for tough spending and taxing decisions. He said yesterday, “The best way to get the budget back into surplus is to restore economic growth”.

It’s very unlikely that driving economic growth will solve the budget’s problems. Firstly, there is not a great deal government can do to create economic growth in the medium term. Small countries like Australia are simply too dependent on what goes on abroad. RBA Governor Glenn Stevens has been saying for some time that he expects below trend growth, and this is reflected in MYEFO’s projections of economic growth rates, which have been revised downward by up to 1%.

Secondly, the history of budget repair elsewhere suggests the hard work of spending cuts and increasing taxes is essential, even if economic growth is above trend.

In our recent Balancing Budgets paper we examined a range of budget repair episodes. One unifying factor of successful budget fixes was that governments made large, structural reforms that were politically painful. They increased taxes, and decreased spending. Almost none did the job without using both levers.

Although it sounds great in theory, they didn’t just grow out of trouble. There are fundamental reasons for this: while government revenues grow in line with the economy, so do government expenses. Government expenses are dominated by salaries (which typically grow at a similar rate to the economy) and welfare payments (mostly tied to average weekly earnings).

The danger in relying on (we should really say wishing for) economic growth is that it indicates government may shirk its responsibility of delivering meaningful budget reform.

Nevertheless, there is plenty of rhetoric in the budget update about “hard decisions”. Promises have been made that the Commission of Audit will recommend, and the May 2014 budget will deliver. The acid test of the Abbott government’s economic credentials will be whether there really are hard decisions in May 2014. As we showed in our recent paper, the only budget decisions big enough to make a difference are also the tough decisions we need.